Protect your accounts receivable process from

Detect fake invoices and customers, payment diversion attempts, and email phishing scams in real-time. Prevent revenue leakage with timely, data-backed decisions.

Unnoticed onboarding red flags that need your immediate attention

Incomplete I-9s or E-Verify Errors

Many hires begin work before their Form I-9 is completed or E-Verify issues are resolved. Unresolved TNCs, missing Section 2s, or outdated documents can lead to serious compliance violations.

SSN, ID & Bank Account Mismatches

Candidates reusing SSNs, submitting mismatched personal details, or sharing bank accounts with others can signal ghost employees or fraudulent identities.

Skipped or Inaccurate Background Checks

Due to internal process gaps, background checks may be delayed, skipped, or marked as "passed" despite discrepancies in education, employment history, or undisclosed criminal history.

Suspicious Onboarding Behavior

Hires who never attend orientation, don’t log into systems, or complete onboarding from unverified locations or devices may not be who they claim. These signals often get ignored without active monitoring.

Accounts receivable red flags that often go undetected until it’s too late

.png)

Fake or inflated invoices

Fake or altered invoices raised by internal teams to meet performance targets and gain personal benefits often slip through standard checks. Without automated validation, these invoices remain untracked for long, leading to financial misrepresentation.

.png)

Ghost customers

Fraudulent entities create fake customer accounts using false documents and purchase goods on credit, leaving businesses with unpaid receivables. Such activities can be hard to detect without real-time verification.

.jpg)

Email phishing

Spoofed emails impersonating company representatives trick customers into paying money to illegitimate accounts or share sensitive data. Without regular tracking, diverted payments come to the surface only after losses occur.

.png)

Lapping schemes

Lapping schemes intending to hide stolen cash by applying one customer’s payment to another’s account remain hidden for long if receivables are not regularly monitored, leading to huge financial losses.

Hobasa

Upgrade Your Onboarding Process with Real-Time Verification and Compliance Intelligence

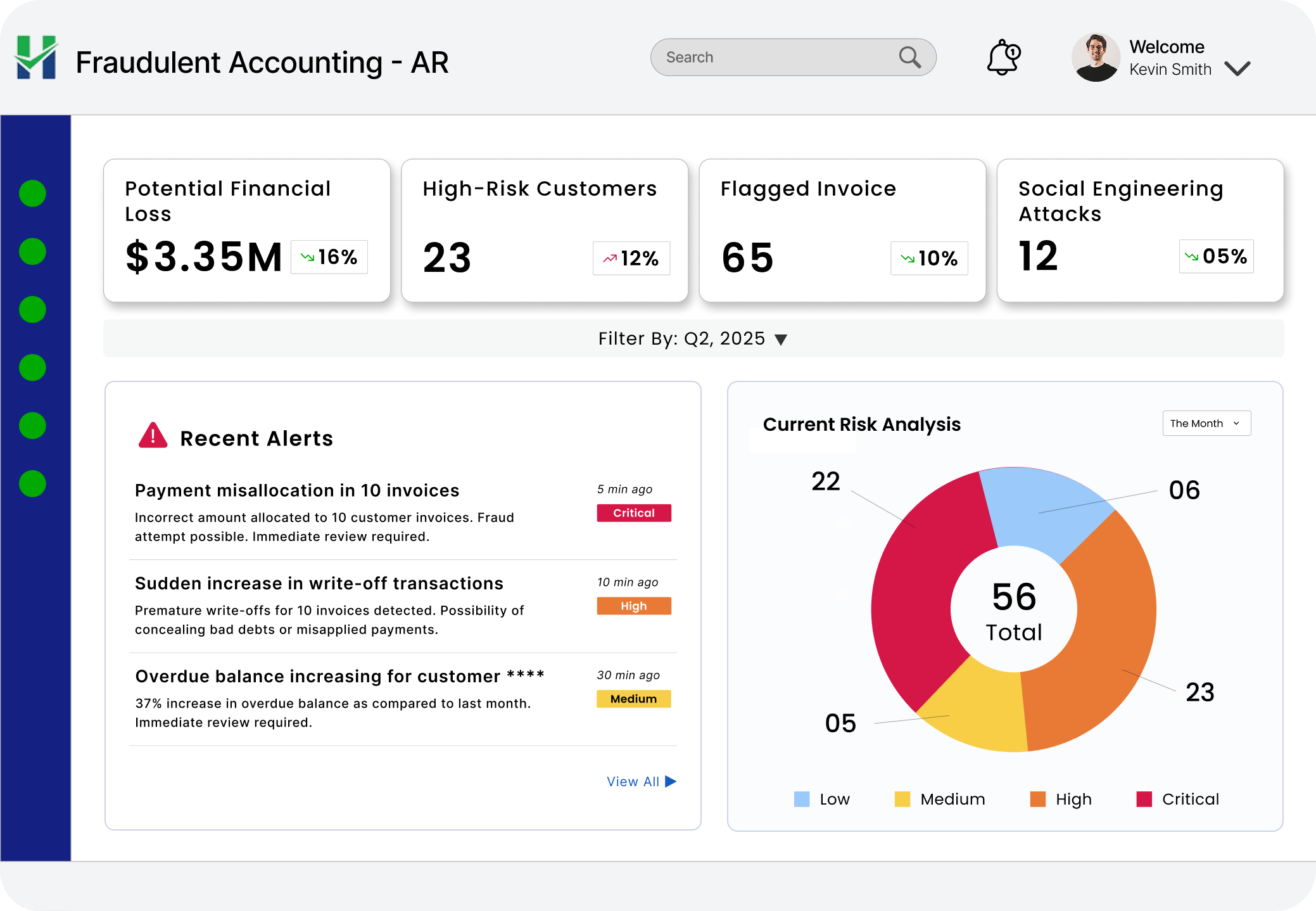

Build a fraud-resistant accounts receivable process with Hobasa

Catch fake or manipulated invoices

Detect fictitious invoices raised by internal perpetrators for personal benefits, distorting your cash flow and AR balance. Real-time alerts enable you to catch invoices with unusual amounts or those with incorrect billing addresses at an early stage, without waiting for month-end reports.

- check Automated cross-checking of invoices

- check Prevent payment misallocations with quick alerts

- check Detailed audit trails help maintain transparency

Block social engineering attacks

Spoofed emails can be hard to spot and are often successful in directing payments into fraudulent accounts. With Hobasa, you can catch such suspicious emails and diversion attempts in real-time. Early detection allows for preventive measures, keeping your accounts receivable process secure.

- check Catch phishing attempts in real time

- check Prevent payment diversions with prompt actions

- check Secure every transaction with advanced checks

Detect high-risk customers in real-time

Hobasa’s AI-powered analytics engine monitors customer activities closely and spots anomalies in real-time. Track customers’ payment behavior, historical trends, credit exposure, and overdue balance. Identify risky accounts showing signs of fraudulent intent or financial distress and take swift action to keep your receivables in good health.

- check Identify customers with suspicious payment activities

- check Eliminate manual reviews and false positives

- check Analyze DSO trends to predict potential defaults

Measure potential losses across receivables

Get a clear view of financial exposure due to fraudulent write-offs, disputed invoices, payment misallocations, and customer defaults. Proactively spot how much money is at risk and its sources — so you can take targeted actions to strengthen collections.

- check Quantify the total invoice value exposed to fraud

- check Predict upcoming cash shortfall with thorough analysis

- check Spot recurring sources of financial leakage

Why Hobasa?

Proactive Alerts

Visual Reports

Seamless integrations