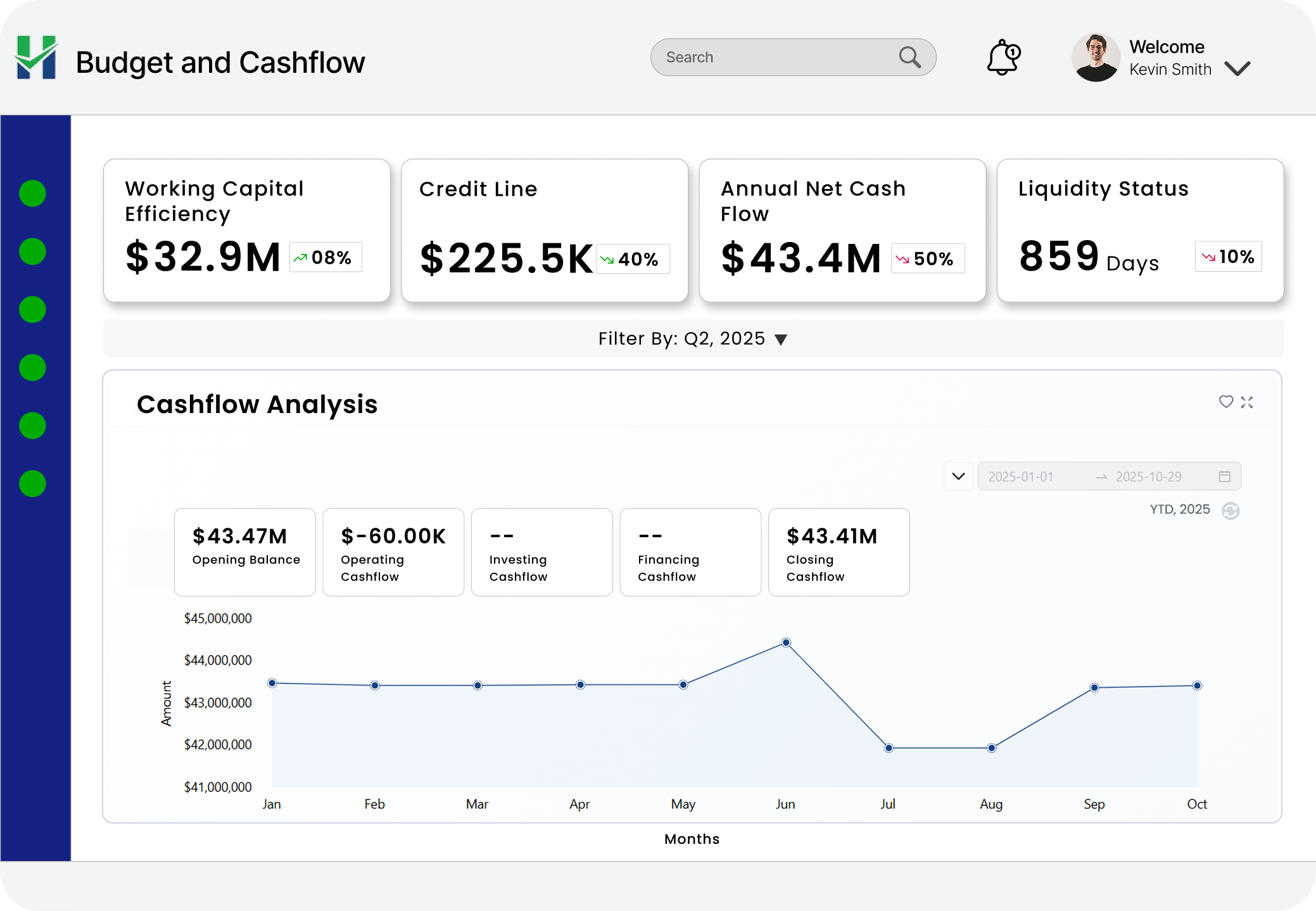

Build financial resilience with

Identify liquidity risks, cash shortfalls, and working capital bottlenecks before they disrupt your operations. Closely track cash movement and make informed decisions to stay ahead of uncertainties.

Unnoticed onboarding red flags that need your immediate attention

Incomplete I-9s or E-Verify Errors

Many hires begin work before their Form I-9 is completed or E-Verify issues are resolved. Unresolved TNCs, missing Section 2s, or outdated documents can lead to serious compliance violations.

SSN, ID & Bank Account Mismatches

Candidates reusing SSNs, submitting mismatched personal details, or sharing bank accounts with others can signal ghost employees or fraudulent identities.

Skipped or Inaccurate Background Checks

Due to internal process gaps, background checks may be delayed, skipped, or marked as "passed" despite discrepancies in education, employment history, or undisclosed criminal history.

Suspicious Onboarding Behavior

Hires who never attend orientation, don’t log into systems, or complete onboarding from unverified locations or devices may not be who they claim. These signals often get ignored without active monitoring.

Hidden risks that weaken your financial stability

Fragmented financial data

Financial data is already complex to decode. Add to that the burden of manually collating data scattered across systems. The result? Analysis becomes a task, decision-making suffers, and risks remain hidden, making it harder to manage budget and cash flow.

![Ineffective_Receivable_Management[1] Ineffective_Receivable_Management[1]](https://lp.hobasa.com/hs-fs/hubfs/Ineffective_Receivable_Management%5B1%5D.png?width=90&height=90&name=Ineffective_Receivable_Management%5B1%5D.png)

Unclear cashflow visibility

Without a consolidated view of inflows and outflows, financial decisions often get delayed. Limited visibility also makes it harder to predict liquidity shortfalls, manage credit lines efficiently, or prepare for unexpected financial stress.

![Lack_of_accurate_forcasting[1] Lack_of_accurate_forcasting[1]](https://lp.hobasa.com/hubfs/Lack_of_accurate_forcasting%5B1%5D.png)

Manual or disconnected forecasting

In a volatile market where the unexpected can happen anytime, relying on spreadsheets with outdated data can lead to inaccurate forecasts, distorting your financial strategies and decisions.

![Fragmented_financial_data[1] Fragmented_financial_data[1]](https://lp.hobasa.com/hubfs/Fragmented_financial_data%5B1%5D.png)

Inefficient working capital management

Poorly managed DSO and DPO cycles keep your cash tied up unnecessarily. Weak coordination between AP and AR means delayed collections, strained liquidity, and inability to carry out operations smoothly.

Hobasa

Upgrade Your Onboarding Process with Real-Time Verification and Compliance Intelligence

Get real-time, 360° financial visibility with Hobasa

Optimize your working capital efficiency

Stay on top of DSO and DPO trends with real-time insights. Track how promptly receivables get converted to cash and payables are settled. Early warning indicators can surface areas where cash is trapped, helping you optimize collections, improve payments, and build smoother cash cycles.

- check Closely track money coming in and going out

- check Detect delayed collections and early payouts

- check Balance your AP and AR with data-driven insights

Keep a close check on your liquidity

Monitor your liquidity position to understand how long you can comfortably meet operating expenses and other short-term obligations without last-minute borrowing. Detect liquidity risks at an early stage and make timely decisions to ensure cash availability at all times.

- check Assess current cash availability

- check Stay prepared for unexpected expenses

- check Identify potential liquidity stress

Track cash movement in real-time

Get a clear, unified view of where your money is coming from and where it’s going. Identify the months with the highest and lowest cash inflow and make proactive decisions to improve cash utilization.

- check Plan spending and investments effectively

- check Track cash flow trends based on historical analysis

- check Maintain a balance between collections and payables

Monitor and manage your credit line

Get full visibility into your short-term borrowing and credit usage. Track total available credit, the amount utilized to date, and your reliance on external financing. Make mindful borrowing decisions to ensure you don’t fall into the debt trap and pay your dues on time.

- check Assess your credit usage at a glance

- check Determine when to draw more credit

- check Negotiate better lending terms

Why Hobasa?

Data-driven alerts

Unified KPI tracking

Interactive reports