Prevent fraud across the employee lifecycle with continuous

Pre-employment checks don’t always guarantee credible hires. Ensure candidate authenticity from day 1 to exit with automated fraud detection and timely risk alerts.

Unnoticed onboarding red flags that need your immediate attention

Incomplete I-9s or E-Verify Errors

Many hires begin work before their Form I-9 is completed or E-Verify issues are resolved. Unresolved TNCs, missing Section 2s, or outdated documents can lead to serious compliance violations.

SSN, ID & Bank Account Mismatches

Candidates reusing SSNs, submitting mismatched personal details, or sharing bank accounts with others can signal ghost employees or fraudulent identities.

Skipped or Inaccurate Background Checks

Due to internal process gaps, background checks may be delayed, skipped, or marked as "passed" despite discrepancies in education, employment history, or undisclosed criminal history.

Suspicious Onboarding Behavior

Hires who never attend orientation, don’t log into systems, or complete onboarding from unverified locations or devices may not be who they claim. These signals often get ignored without active monitoring.

Employee fraud risks that slip through the cracks — costing you time and money

Hobasa

Upgrade Your Onboarding Process with Real-Time Verification and Compliance Intelligence

.png)

Payroll and compensation manipulation

Employee misclassification, shared bank accounts, and duplicate payments are all signs of payroll fraud that often go undetected without stringent internal checks, leading to significant financial losses that can go up to $45000, per instance.

.png)

Attendance fraud

From buddy punching and inflated work hours to clock-in and clock-out irregularities, attendance fraud can take various forms and evade detection for months, impacting payroll and creating an unfair work environment.

.png)

System abuse

Unauthorized access to HR or payroll systems and bulk download or upload of files are clear signs of fraud. If not detected in time, these insider threats can lead to serious financial and compliance risks.

.png)

Identity and credential fraud

Fake degrees and falsified work experience can bypass standard background checks, creating entry points for fraudulent candidates. According to ACFE, 29% of fraud cases last over 24 months into an employee’s tenure before detection - driving up reputational damage and financial losses.

Build a trustworthy and fraud-free workforce with Hobasa

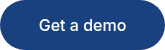

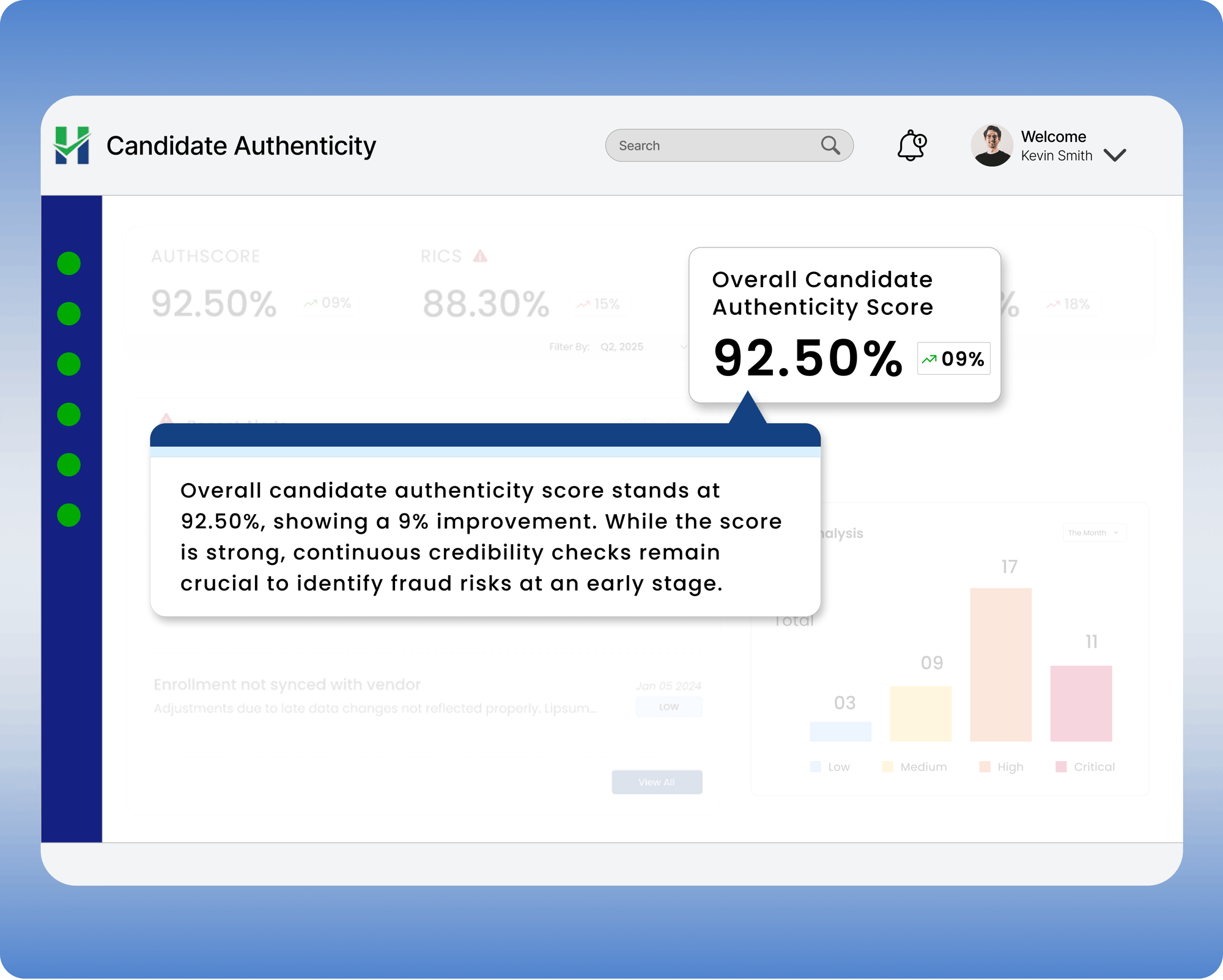

Continuous authenticity checks across the employee lifecycle

Gauge the integrity of your hiring process and overall candidate authenticity with a single score. Hobasa helps you catch fraud signs such as benefit abuse, fake work hours, and duplicate bank accounts at the earliest, so you can intervene on time and prevent costly consequences.

- check Go beyond one-time pre-employment screening

- check Get early warning on falsified identity, work, and experience credentials

- check Detect payroll manipulation, attendance irregularities, and more

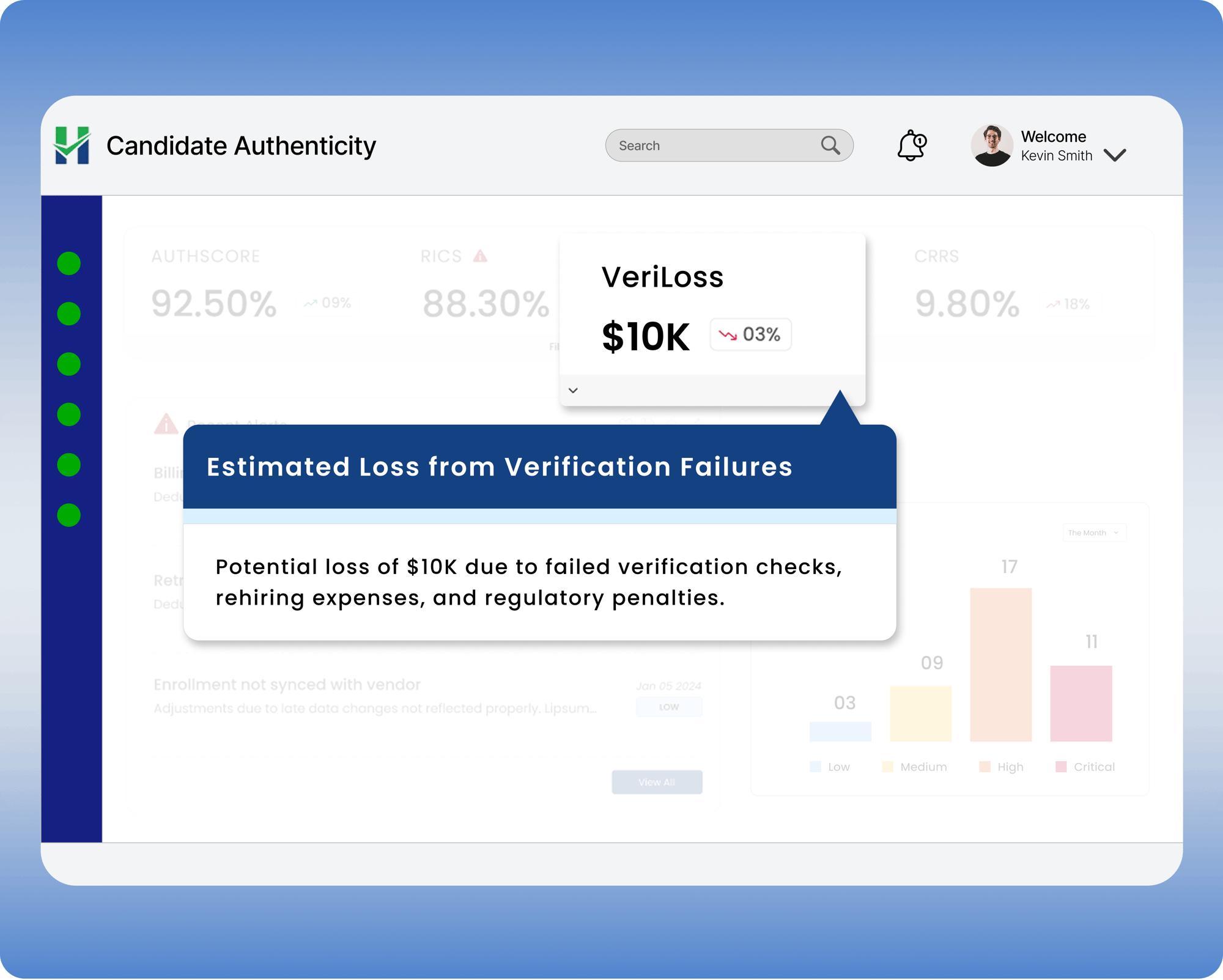

Quantify potential losses from candidate verification failure

Get an estimate of how much money your company might lose due to mis-hires who fail verification checks or are terminated due to fraudulent activities. This figure factors in recruitment, training, and rehiring costs, penalties from compliance violations, and fraud investigation expenses.

- check Estimate the total loss from employee verification failure

- check Measure financial risks linked with compliance breaches

- check Take proactive measures to strengthen hiring and prevent fraud

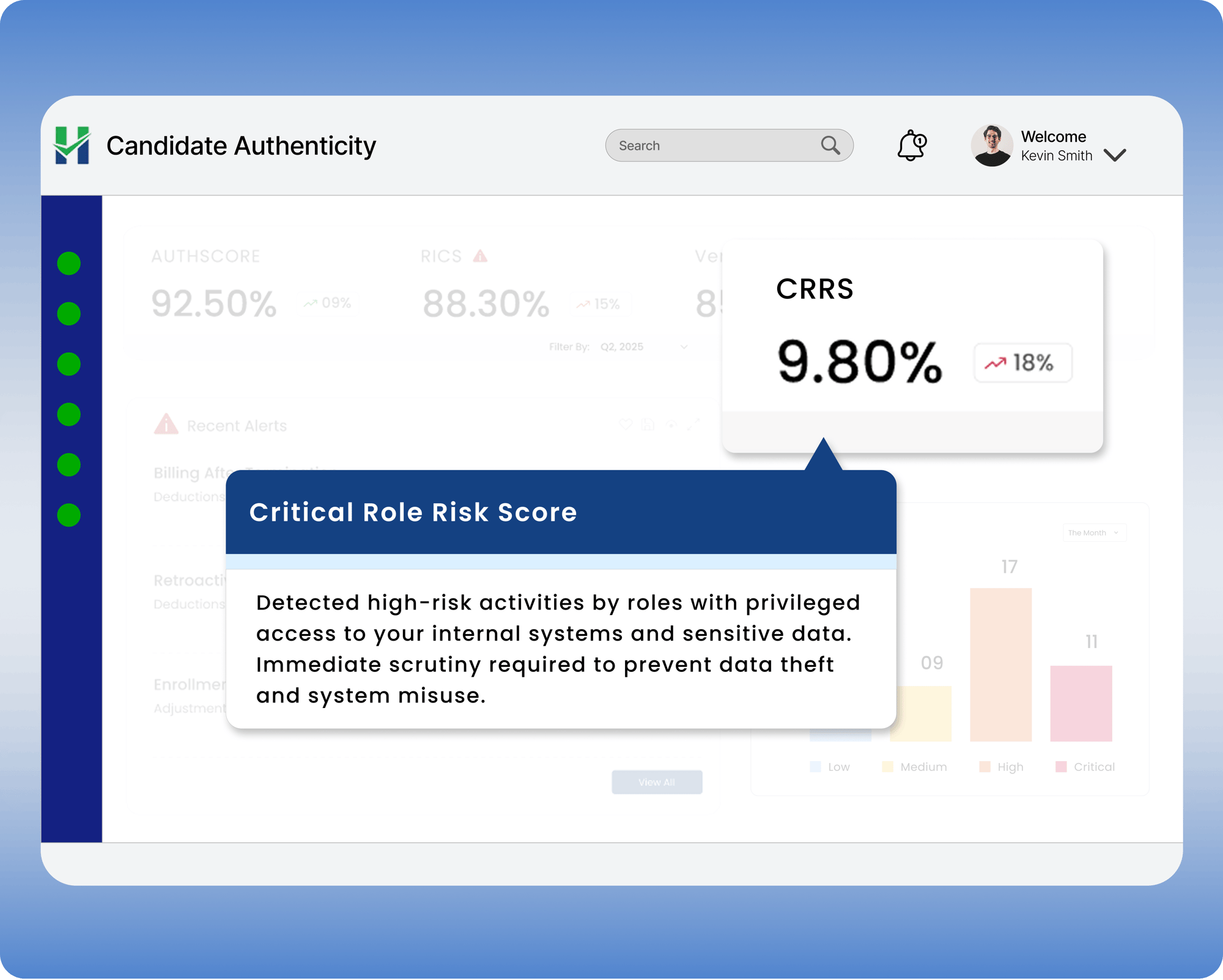

Monitor insider threats from critical roles

When high-value employees with privileged access to internal systems misuse their rights, it can compromise data security and disrupt business operations. With Hobasa, it’s easy to spot signs of insider threats and take preemptive measures to strengthen security.

- check Track suspicious activities by those in strategic roles

- check Detect unauthorized data download and unusual system access

- check Guard your intellectual property with proactive monitoring

Why Hobasa?

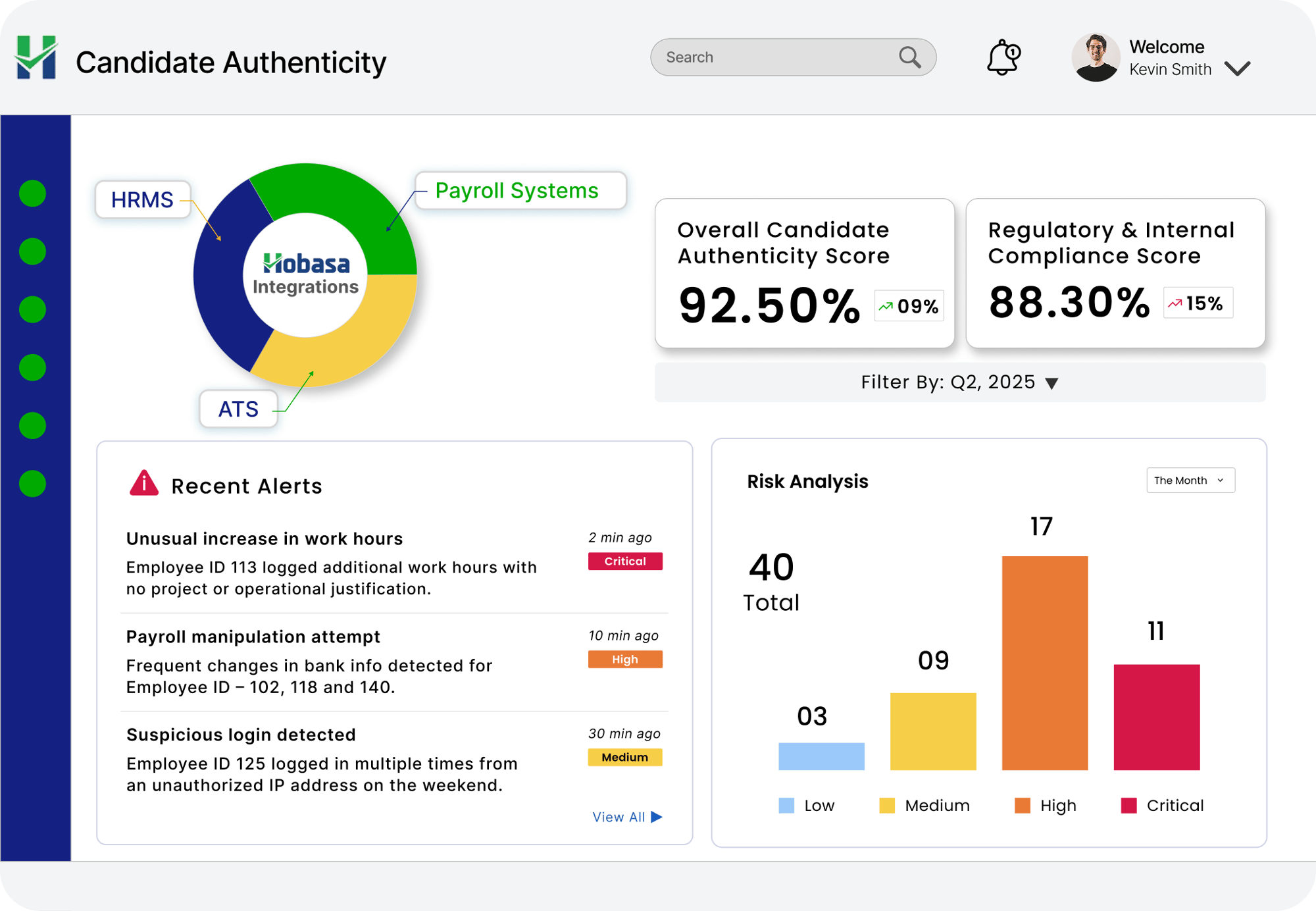

Real-time fraud alerts

Get instant alerts on suspicious activities such as policy abuse, fake reimbursement claims, unauthorized system access, or invalid bank routing numbers, to initiate actions and prevent losses.

Seamless integrations

Hobasa connects seamlessly with ATS, HRIS, payroll, and background check platforms, giving you a single source of actionable insights to monitor employee activities, detect anomalies, and mitigate fraud risks.

Risk trend analysis

Gauge patterns of misconduct and fraud by existing employees. Dig deeper and address these issues before they escalate into severe financial or legal challenges.