Secure your benefits administration process with real-time

Get early warning on benefits billing issues, ineligible enrollments, and compliance risks. Prevent benefits misuse and ensure vendor accountability with real-time alerts.

Benefits process red flags that often slip through manual checks

.png)

Billing discrepancies

Inflated bills or unexplained premium hikes are signs of fraudulent activities by vendors. Without automated cross-verification, these fraud risks often slip through, hurting your company’ financial health.

Enrollment and eligibility errors

Terminated employees still receiving benefits and fake dependents can easily bypass weak internal checks, leading to audit failure and amplifying your total benefits spend. Failing to identify and track full-time eligible employees accurately can trigger penalties of $2,970–$4,460 per employee per year

.png)

Misaligned payroll & benefits

Discrepancies between carrier billing, employee coverage, and payroll deductions trigger employee disputes, regulatory scrutiny, and financial losses. Benefits abuse or payroll leakage can lead to median losses of $100K per incident.

SOP & contract violations

Deviations from internal SOPs and vendor contracts often get ignored without regular monitoring, impacting process integrity and opening door to legal complications.

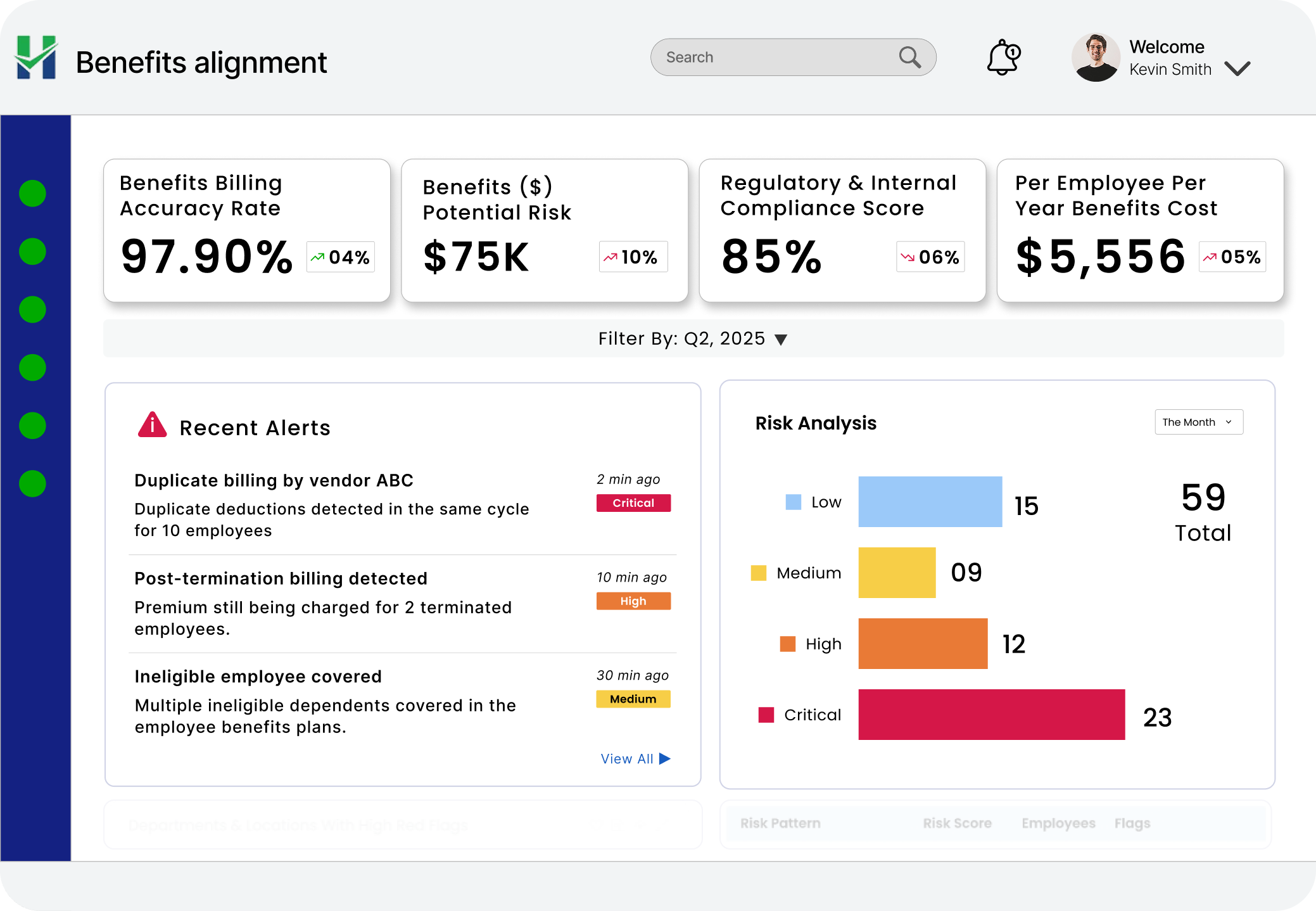

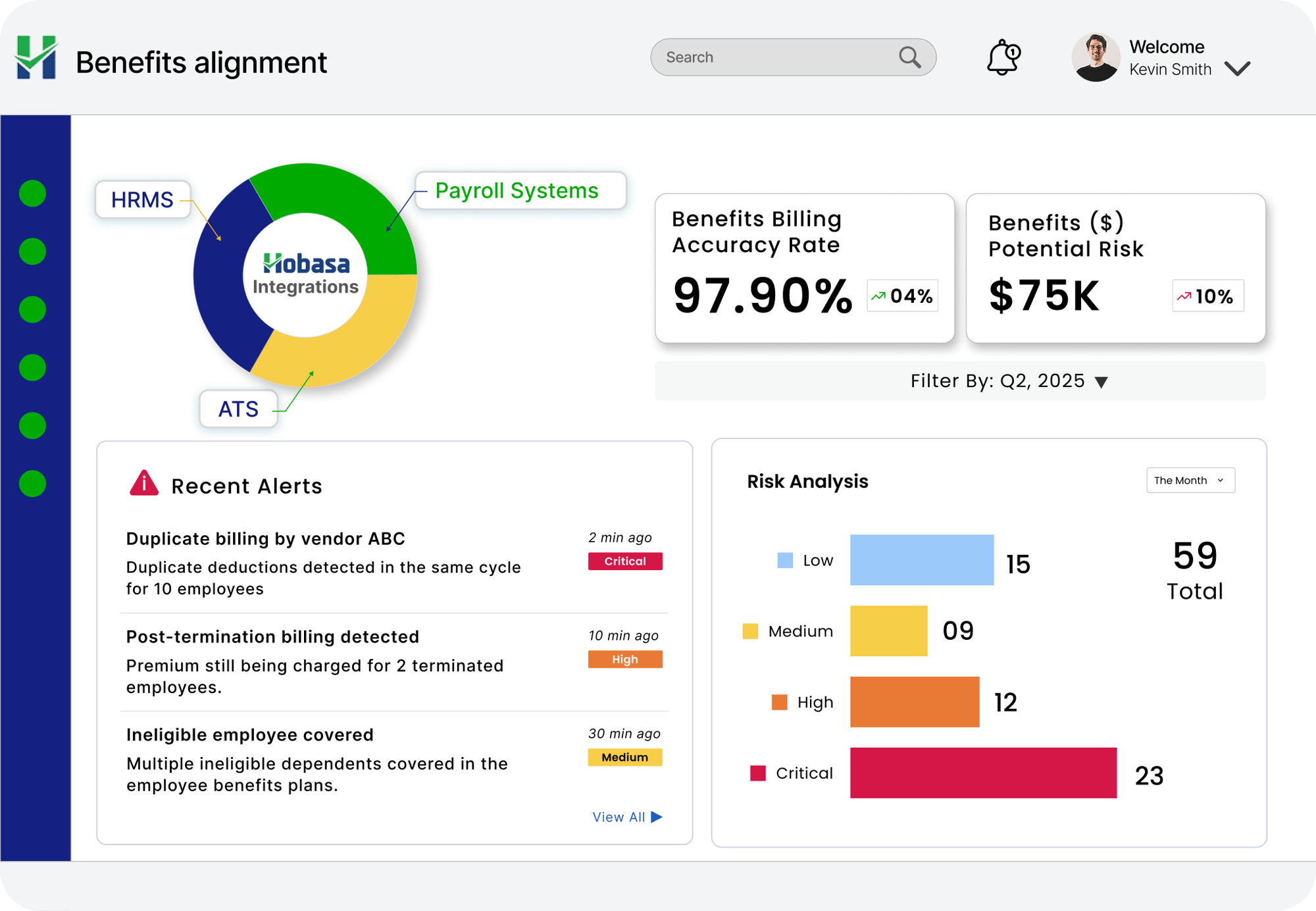

Hobasa : #1 solution to expose hidden risks in your benefits administration process

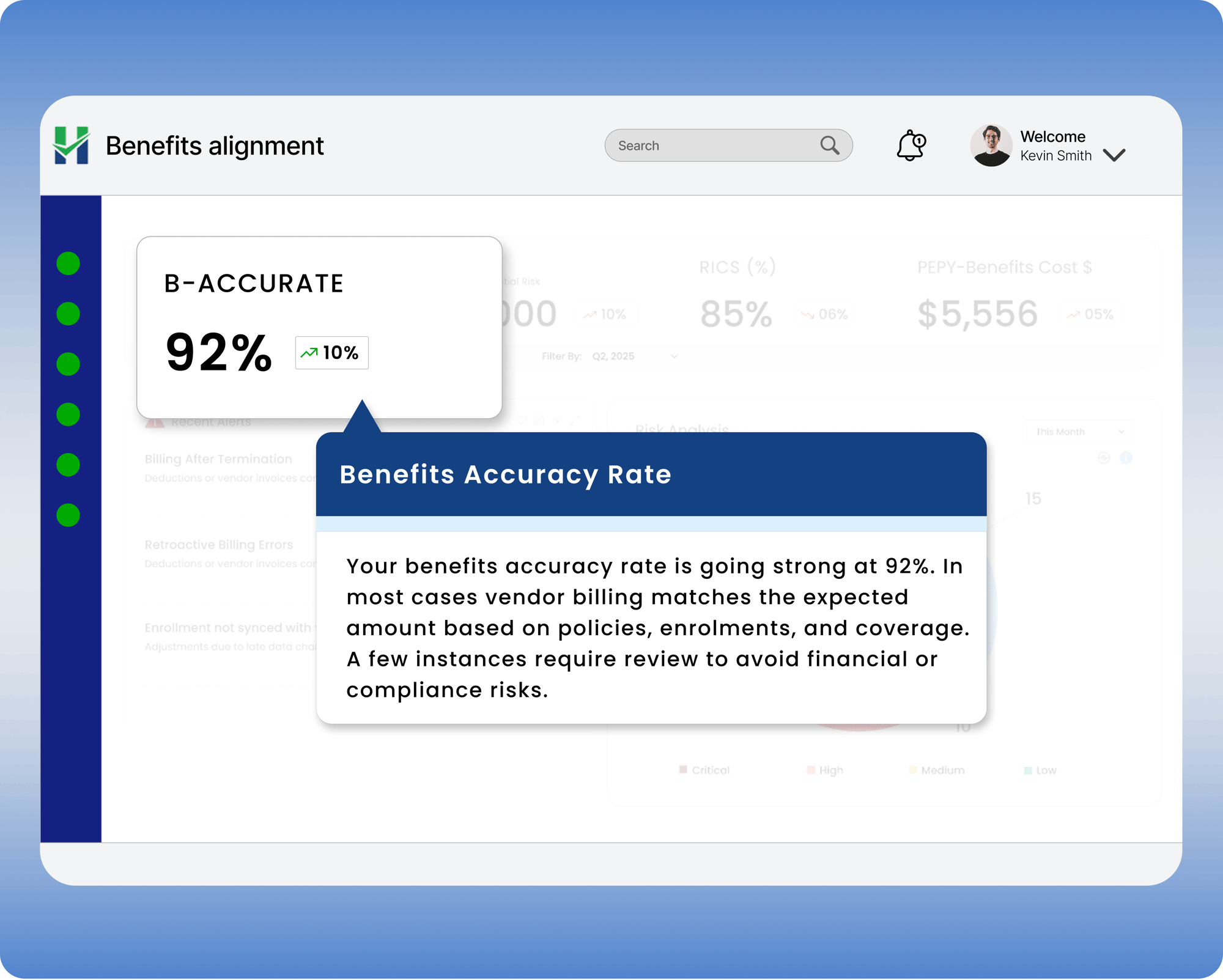

Analyze benefits billing accuracy

Benefits billing errors and fraud risks remain undetected for long due to fragmented systems and weak internal checks. Hobasa continuously scans data across payroll, HCM, and carrier systems, surfacing discrepancies in real-time. Catch instances of overbilling, duplicate charges, ineligible dependents and late enrollments — and take prompt action before they impact your bottom line.

- check Flag anomalies across HCM, payroll, and carrier systems

- check Track recurring billing errors and internal process gaps

- check Initiate immediate investigation and policy audits

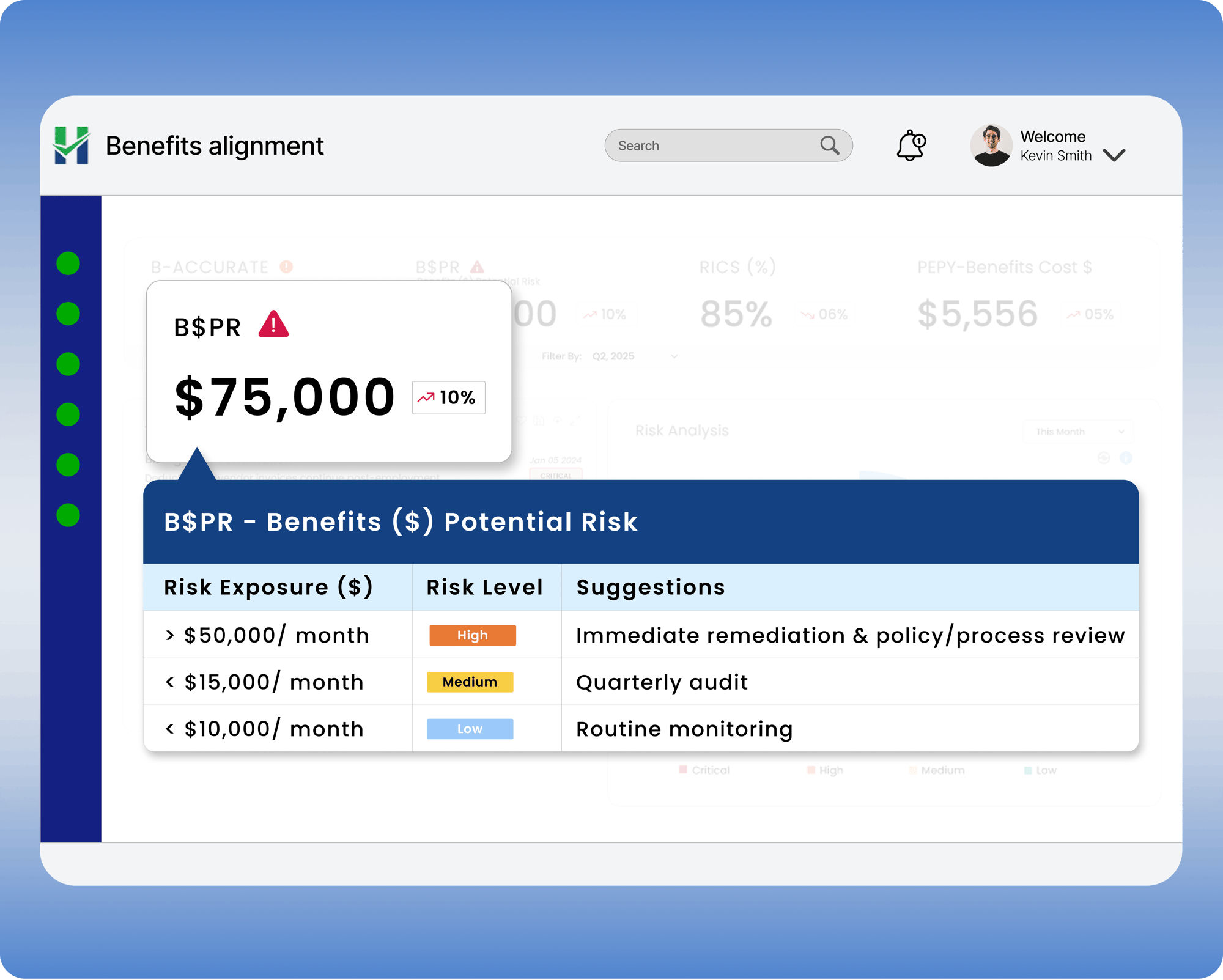

Quantify potential losses from benefits fraud

Get an estimate of how much money is at stake from billing fraud, enrollment errors, and compliance violations. With continuous monitoring, Hobasa helps you proactively visualize hidden financial risks, empowering you to take preemptive measures, prioritize high-impact issues, and prevent losses.

- check Quantify financial exposure from hidden risks

- check Turn potential losses into measurable savings

- check Take targeted actions based on data-driven insights

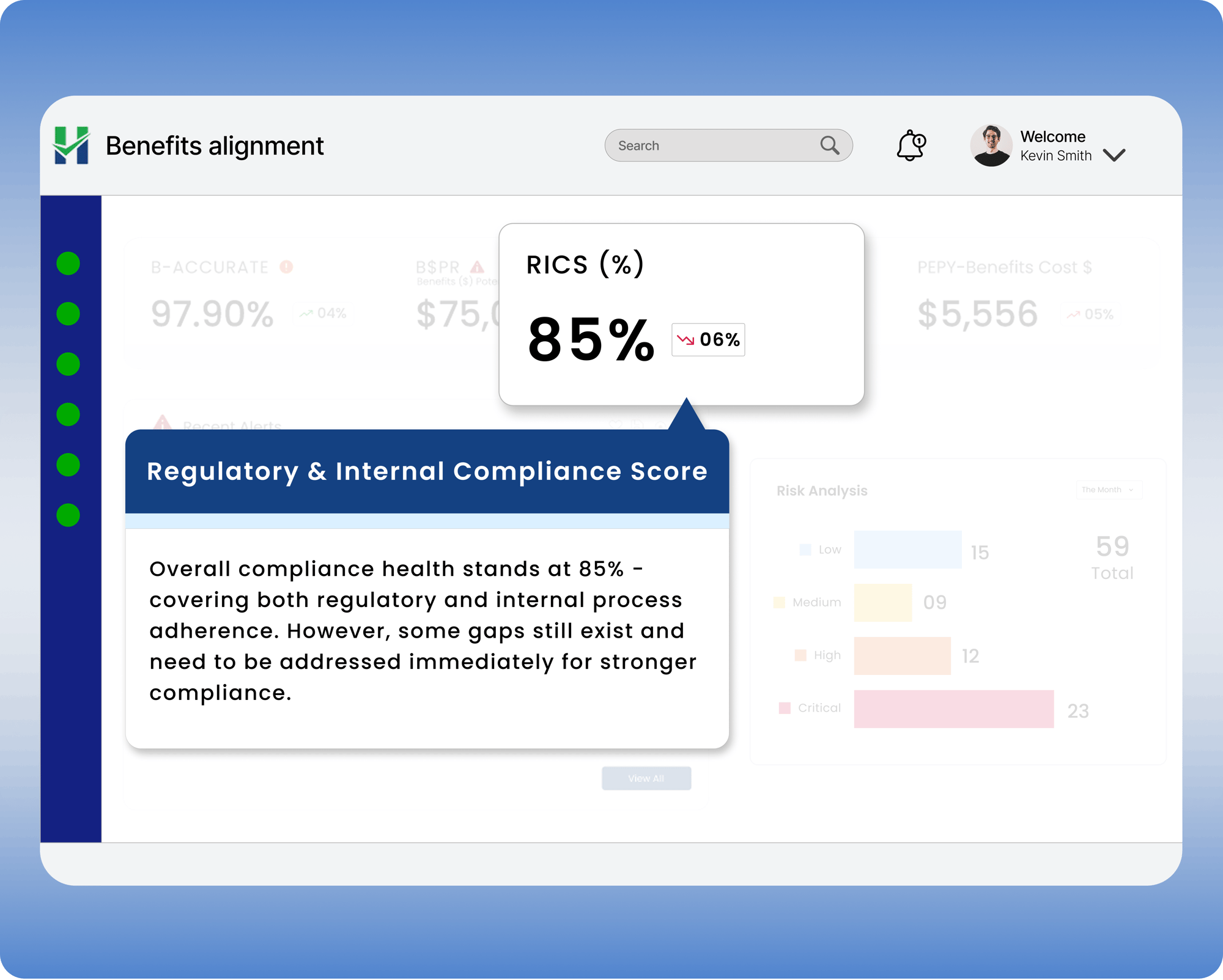

Regularly monitor your benefits compliance health

Gauge how well your benefits process adheres to ACA, COBRA, as well as internal policies. Automated validation of benefits claims, vendor bills, and dependent documents helps you identify process gaps and fraud risks in real-time, preventing reporting violations and costly penalties.

- check Track compliance status across employees, plans, and vendors

- check Strengthen audit-readiness with regular compliance health checks

- check Receive early warning on potential violations and policy breaches

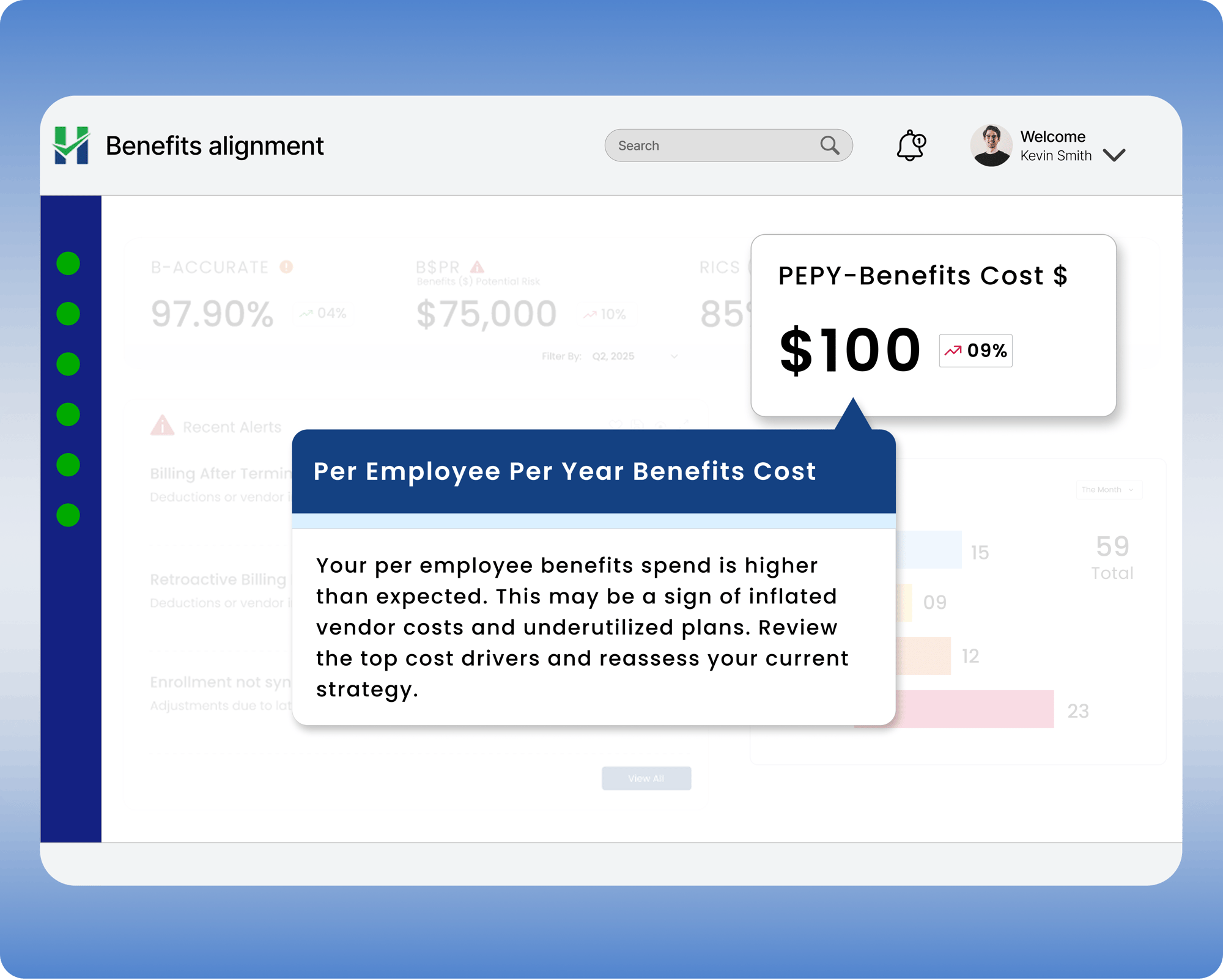

Track and optimize your total benefits spend

Measure your average yearly benefits spend with a single metric that takes into account your contribution for health insurance, retirement plans, wellness programs, and much more. Assess the efficiency of your benefits programs and spot areas driving expense increase. Watch out for risk signals indicating overinvestments in plans and low participation from employees.

- check Get a real-time view of your yearly benefits spend

- check Pinpoint areas driving up benefits expenses

- check Optimize benefits budget using data-driven insights

Why Hobasa?

Real-time alerts

Get instant alerts every time there are compliance violations, policy breaches, or when red flags are detected, such as ineligible employees getting benefits or missing beneficiary details.

Seamless integrations

With Hobasa, all your disconnected systems — HCM, payroll, and time-tracking tools work as one powerful engine, flagging anomalies across platforms, so your team knows where and when to intervene.

Visual dashboards

From billing accuracy to benefits compliance, our intuitive score cards and graphs give a clear picture of where your organization stands and pinpointing the exact areas that need your team’s undivided attention.