Protect your accounts payable process from

Detect fraudulent activities, payment discrepancies, and compliance breaches – all from one smart dashboard. Make proactive decisions with real-time alerts and keep your AP process free of fraud.

Accounts payable frauds that often go unchecked - until it's too late

.png)

Fake or unverified vendors

Without a stringent vetting process, fake and unverified vendors easily enter your system undetected, leading to payment fraud, with median losses reaching up to $120K, as per ACF reports.

.png)

Suspicious transaction patterns

Unusual transactions involving a sudden spike in payments & frequent changes in vendor bank details can be signs of fraud. Without rigorous internal checks, these patterns often go untracked, leading to financial losses.

.png)

Social engineering attacks

Spoofed emails impersonating reliable vendors and asking for urgent payments often slip past internal checks. These emails can easily trick the AP team into approving payments to fraudsters, increasing the risk of losing not just money but also sensitive information.

.jpg)

Invoice errors & discrepancies

Fake or inflated invoices, mismatched payments, and minor variations in billing details can easily get overlooked during manual checks. And by the time such errors are detected, the damage has already happened.

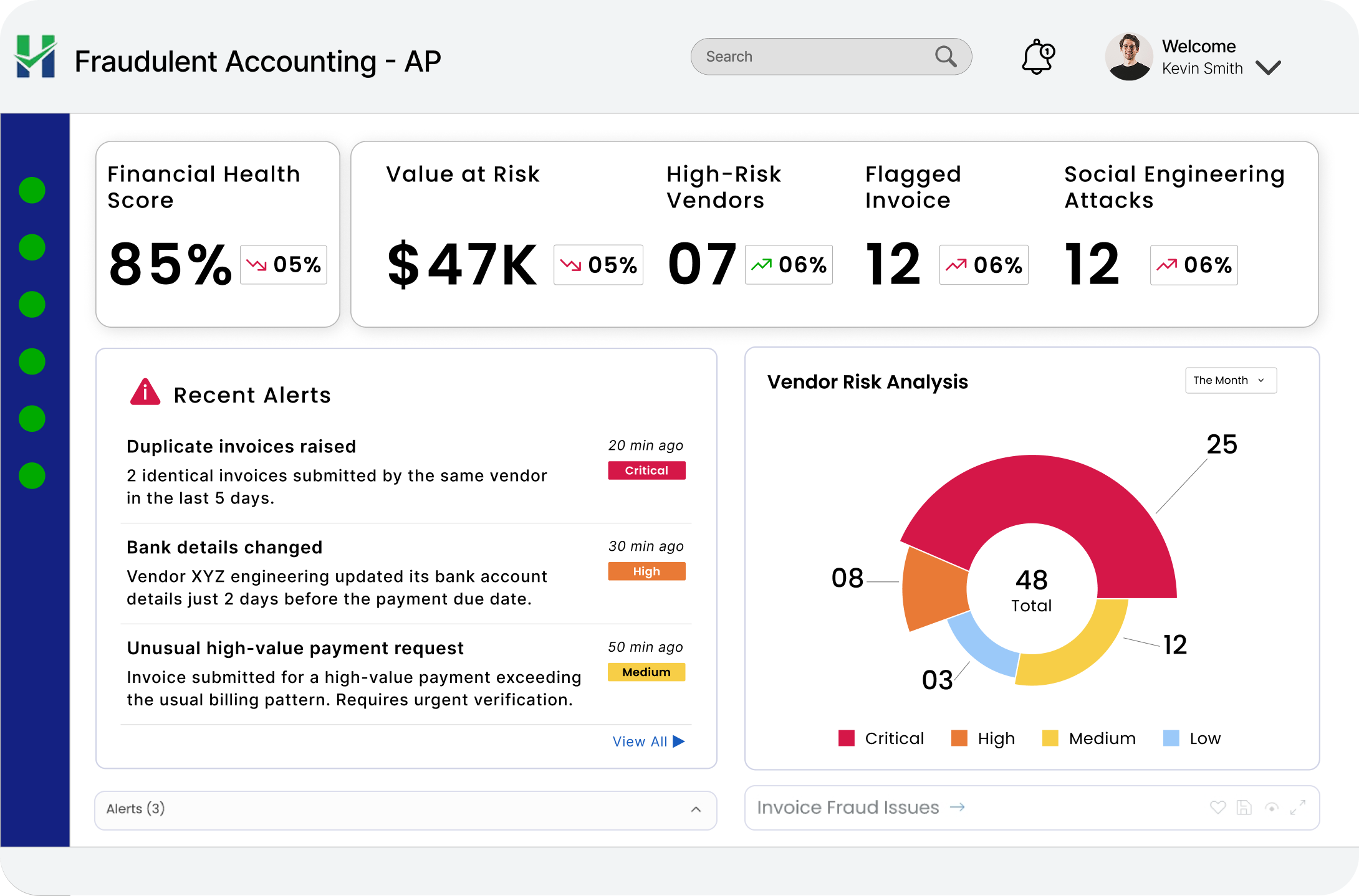

Fraud-proof your payments process with Hobasa

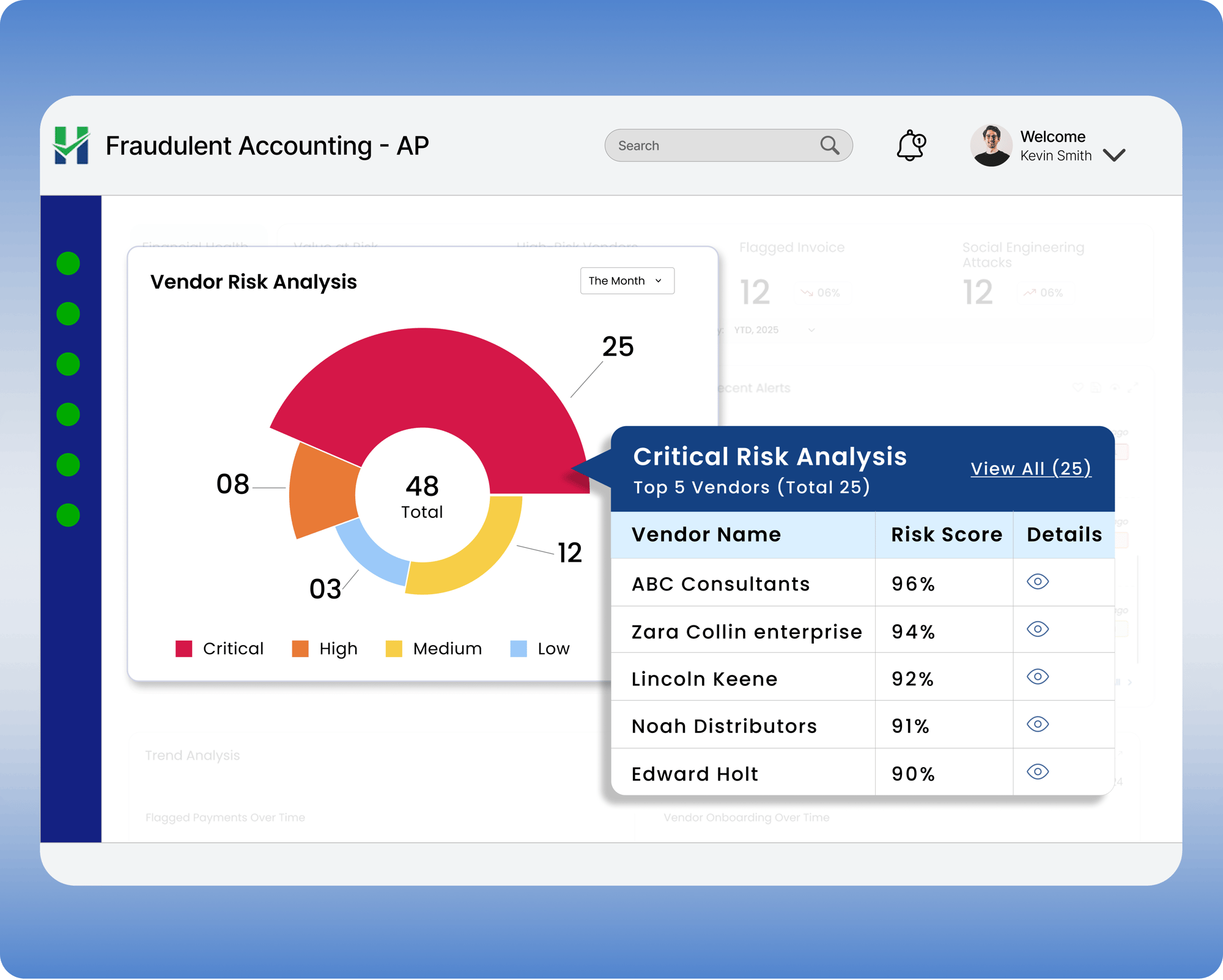

Detect high-risk vendors

Identify vendors with incomplete KYC, fake or duplicate profiles, and those not complying with FATCA and OFAC regulations, during the onboarding process and throughout the transaction lifecycle. Find fraudulent vendors proactively and eliminate them in time – before they disrupt your operations.

- check Spot inconsistencies in vendor documents

- check Monitor fraud risk throughout transactions

- check Track vendors violating regulatory rules

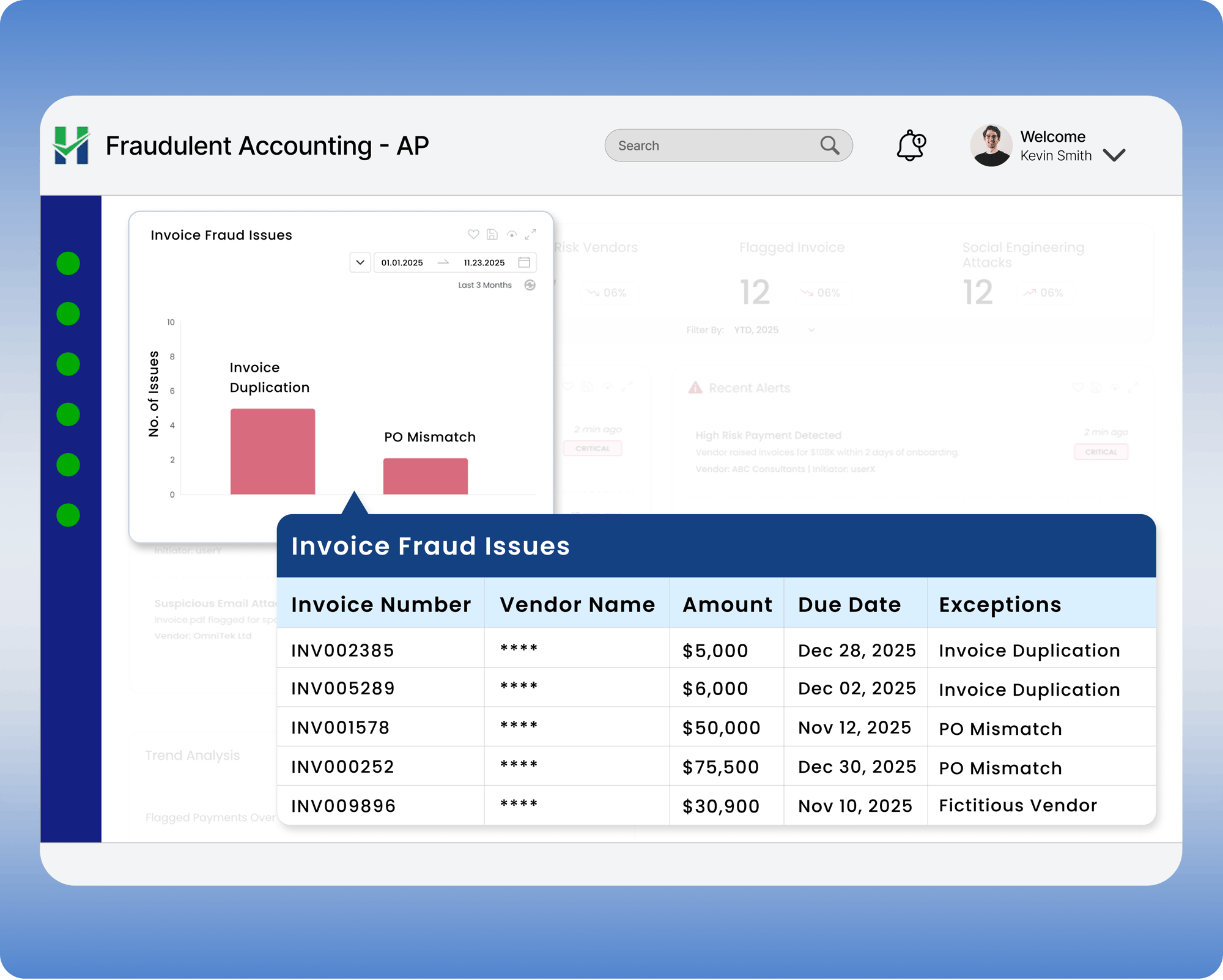

Spot invoice discrepancies

Our Accounts Payable tool flags duplicate, false, or ghost invoices and payment discrepancies in real time. Get quick alerts on suspicious activities like frequent changes in vendors’ bank details and multiple high-volume invoices submitted on the same day.

- check Track and prevent payment anomalies

- check Identify mismatch between invoices, purchase orders, and receipts

- check Investigate flagged invoices to eliminate fraud risks

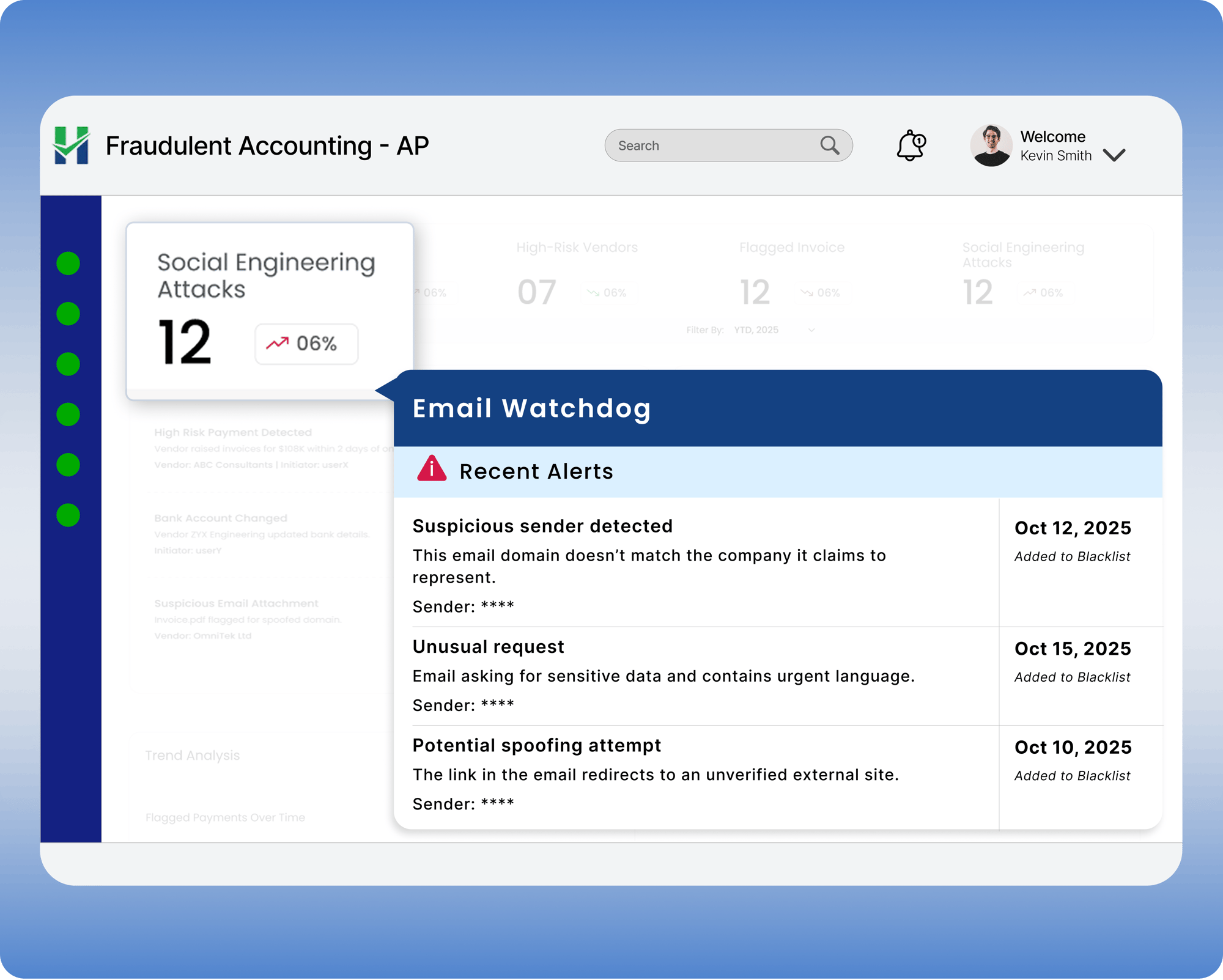

Block social engineering attacks

Spot impersonation attempts, spoofed emails, unusual payment requests, and sudden changes in bank details. Take immediate action before fraudsters creep into your system and cause serious damage.

- check Catch fraud attempts early

- check Monitor suspicious email communication patterns

- check Flag emails from inactive or blacklisted vendors

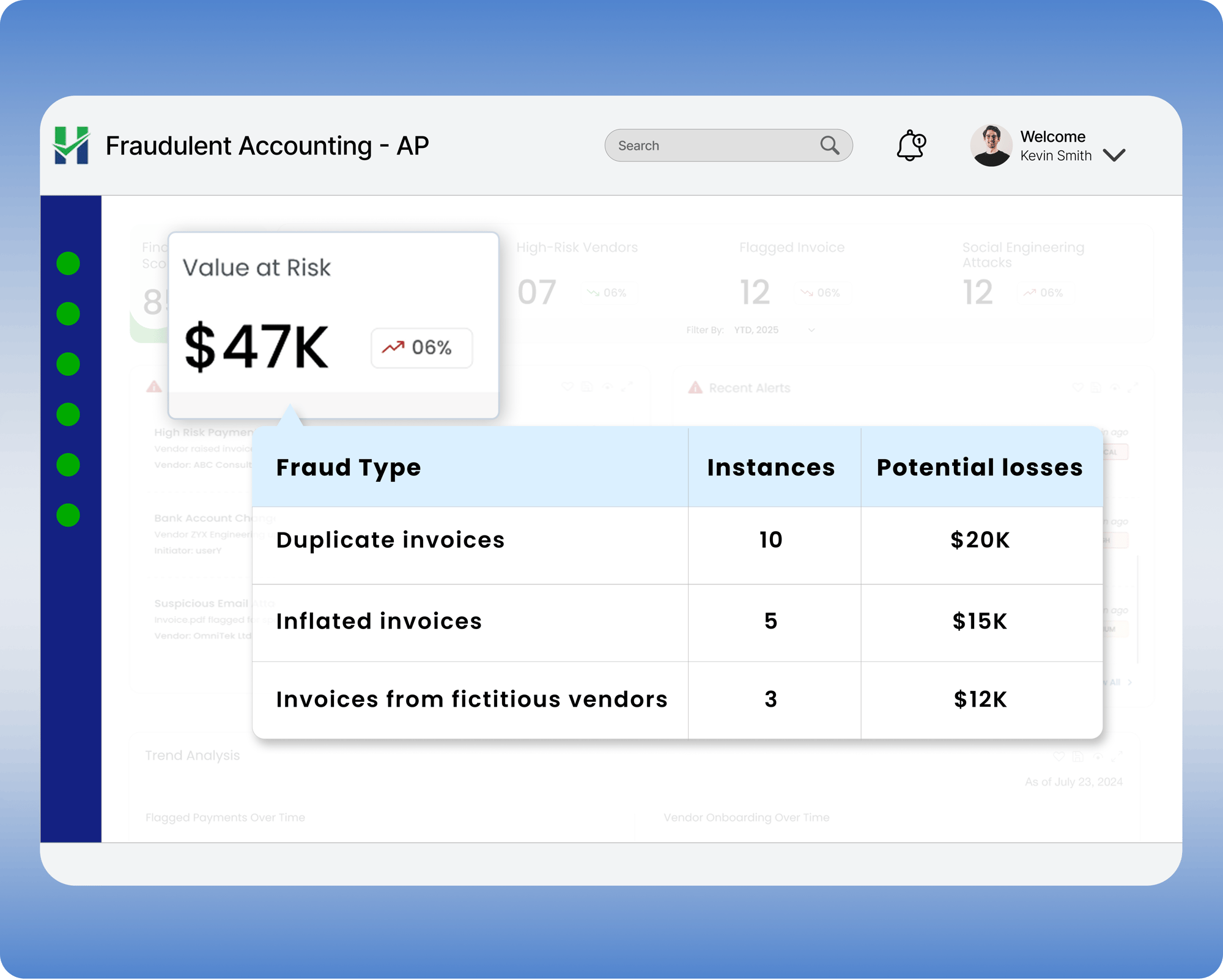

Assess potential financial exposure

Quantify the potential losses you might incur due to vendor and invoice fraud. Intervene when necessary and take prompt steps to prevent legal and financial exposure.

- check Measure the legal implications of fictitious vendors

- check Track the total value of fake invoices

- check Quantify cost savings from early fraud detection

Why Hobasa?

Unchecked AP Gaps = Costly Financial & Legal Consequences

Prompt alerts

Robust integrations

.png?width=100&height=100&name=image%20(23).png)

Intelligent 3-way matching

.png?width=100&height=100&name=image%20(22).png)