Fraud-proof your employee onboarding process with real-time

Identify dishonest candidates before onboarding completes. Catch fake documents, signs of misdemeanor, and unverified credentials in time to prevent financial and legal exposure.

Unnoticed onboarding red flags that need your immediate attention

Incomplete I-9s or E-Verify Errors

Many hires begin work before their Form I-9 is completed or E-Verify issues are resolved. Unresolved TNCs, missing Section 2s, or outdated documents can lead to serious compliance violations.

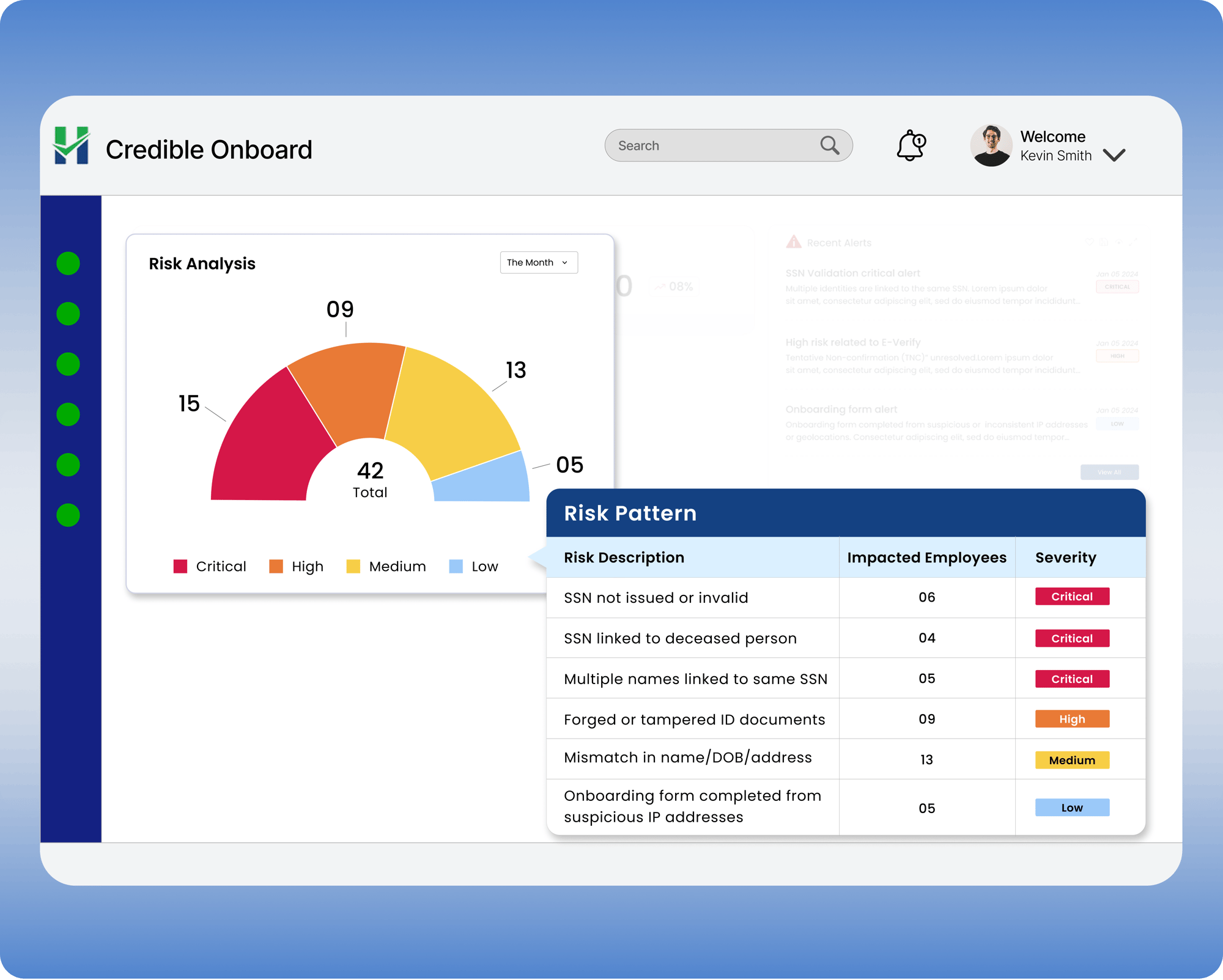

SSN, ID & Bank Account Mismatches

Candidates reusing SSNs, submitting mismatched personal details, or sharing bank accounts with others can signal ghost employees or fraudulent identities.

Skipped or Inaccurate Background Checks

Due to internal process gaps, background checks may be delayed, skipped, or marked as "passed" despite discrepancies in education, employment history, or undisclosed criminal history.

Suspicious Onboarding Behavior

Hires who never attend orientation, don’t log into systems, or complete onboarding from unverified locations or devices may not be who they claim. These signals often get ignored without active monitoring.

Employee onboarding red flags that put your business at risk

Fake or altered documents

Manipulated education certificates, forged bank documents, and unverified identity credentials often go undetected during onboarding, leading to legal and financial hassles.

I-9 violations alone can bring penalties of up to $28,619 per unauthorized worker.

Background check discrepancies

Most background screenings only scratch the surface, missing critical gaps in employees’ work and education history.

According to ACFE, 84% of background checks on employees who committed fraud failed to reveal red flags – despite internal controls.

Suspicious onboarding behavior

New hires who never attend orientation, complete onboarding from unverified locations, or those using shared SSNs may not be who they claim.

Such unusual fraudulent activities often get ignored without active monitoring, resulting in median losses of up to $150,000.

Hobasa

Upgrade Your Onboarding Process with Real-Time Verification and Compliance Intelligence

Credible Onboard: Designed for secure & compliant employee onboarding

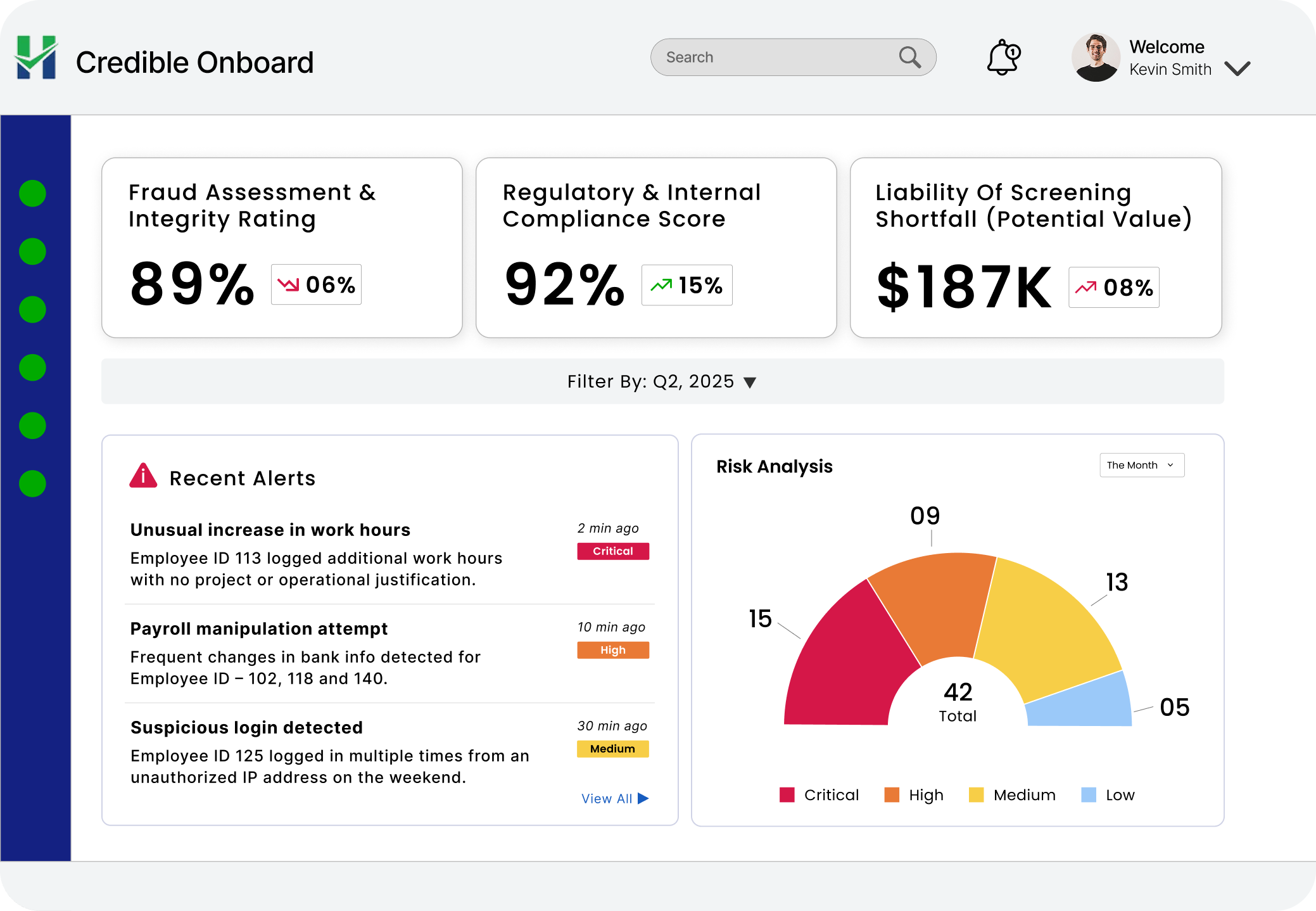

Validate candidate credibility

Check candidate credibility and risk profile using centralized KPIs - and stop onboarding at the very first sign of fraud. Detect discrepancies in work history, identity documents, and education certificates in real-time. Make timely decisions to stop risky candidates from moving forward in the onboarding process.

- check Verify I-9 and SSN in real-time

- check Flag gaps in employment history

- check Detect suspicious and high-risk behavior

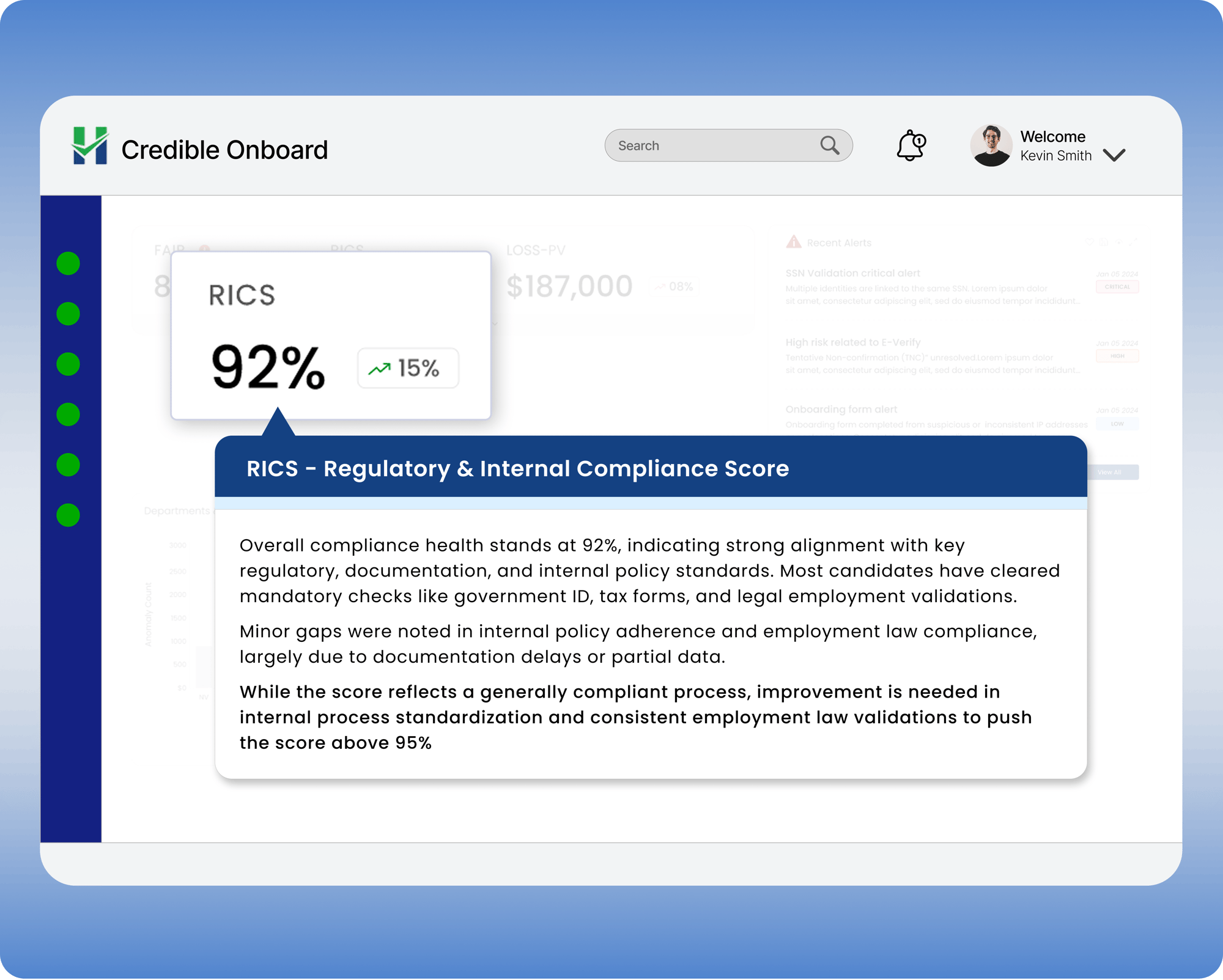

Quantify compliance exposure

Track compliance with HR-related regulatory and internal policy requirements in real time to improve audit readiness and avoid penalties. Measure compliance with immigration laws, drug testing policies, and more from one centralized dashboard.

- check Measure HR compliance with a unified score

- check Detect compliance violations with real-time alerts

- check Reduce legal exposure and costly penalties

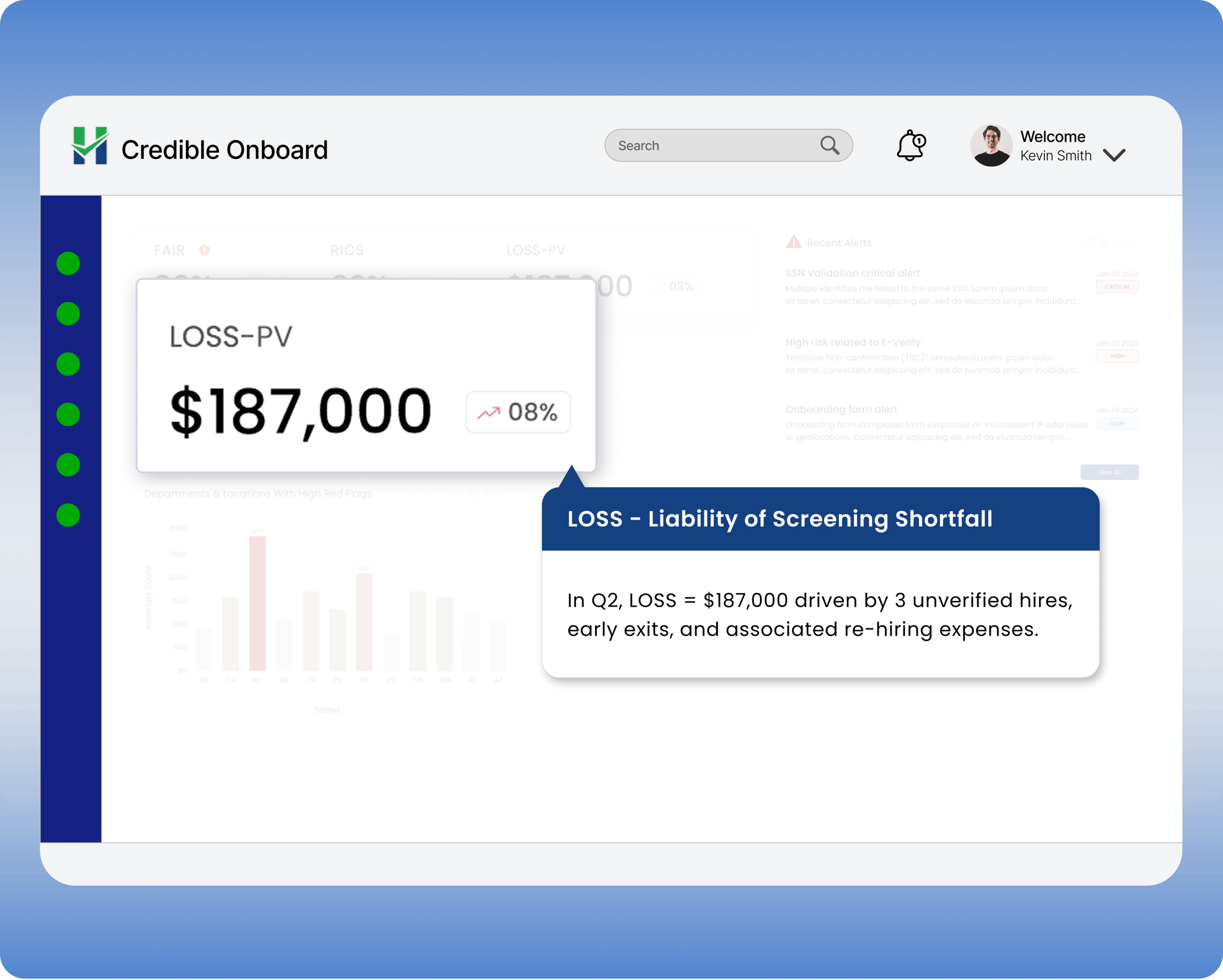

Measure the cost of fraudulent hiring

From re-hiring and re-training costs to lost project revenue and regulatory penalties - gain complete visibility into how negligent and non-compliant hiring impacts your bottom line.

- check Measure the financial impact of non-compliance

- check Quantify productivity loss from wrong hiring

- check Monitor revenue impact of early exits

Why Hobasa Credible Onboard?

Real-time alerts

Centralized KPIs

Risk trend analysis